Financial Management

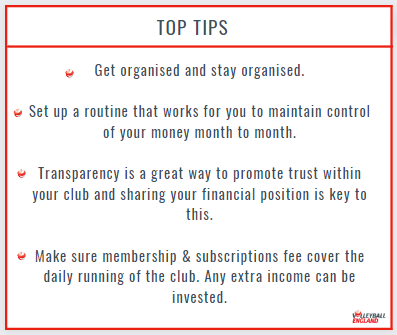

Managing your money is an essential part of good club management and is vital to running a sustainable sports club.

Although managing the day-to-day finances of your sports club can seem a daunting or tedious task, if you have thorough planning & budgeting in place it will support your club in the long term.

Have you thought about?

What are your costs?

- How much will your facility cost to hire?

- Will you need to pay your coaches?

- Have you purchased equipment?

- Do you know the maintenance costs?

What funding streams are available to support you?

- Contact your local Active Partnership and local authority to see if they have funding available

- View the Sport England funding options

- Community Amateur Sports Club

- Crowdfunder

- Easyfundraising

Information to support you with funding applications can be found on our funding page.

Annual accounts

- At the end of your club's financial year, you should prepare your annual accounts - this is typically done by your club treasurer.

- Once you have prepared the accounts, you should ask someone independent (i.e. not the person who prepared them) to review the accounts; the person reviewing should have suitable financial knowledge and experience to do this properly.

- If your club is membership based, you should publish your annual accounts (or a summary of) for your members to access - you could share this using your club website, newsletter, by e-mail or another method that works for you and your club.

Bank accounts

A club requires a bank account with at least 2 signatories from your club committee (these committee roles should be held by different individuals who are not related).

There are numerous bank accounts that can support your club. You will need to consider which bank account best suits your organisation, we have listed some below:

- Virgin Money - Charities, Clubs & Societies Account

- Eligibility Criteria & Benefits

- Have a turnover of less than £100,000

- Take control with digital tools

- Earn Cashback on Debit Card transactions

- Eligibility Criteria & Benefits

- Natwest - Community Bank Account

- Eligibility Criteria & Benefits

- Have a turnover of less than £100,000

- 24/7 Online Banking and Phone Banking

- Digitally sign payments & account changes with other members of your group

- Eligibility Criteria & Benefits

- Lloyds - Treasurers Account

- Eligibility Criteria & Benefits

- Have a turnover of less than £50,000

- Manage account online and by phone

- No minimum deposit amount required

- Eligibility Criteria & Benefits

- Barclays - Community Account

- Eligibility Criteria & Benefits

- Have a turnover of less than £100,000

- Authorise up to three individuals as signatories on the account

- Manage account online

- Eligibility Criteria & Benefits